Nobody expects buying a home to be cheap. But there are many costs that unsuspecting buyers may not be aware of. The various additional fees, such as appraisals or Owner Title Insurance, can add up to five-figure sums.

Knowing about these costs in advance can help first-time buyers prepare for the bold and exciting step of bidding on a home. And it can help those already on the property ladder to consider their best next move. Figuring out potential fees is also a way to get into good habits ahead of dealing with other ongoing home ownership costs such as monthly utilities and essential maintenance — which experts estimate can cost around $1,180 on average.

Buyer fees include charges for things like home inspection and appraisals, which reassure you and your lenders that the home you’re buying does not have any hidden surprises of its own — such as structural issues. But they also include everything from taxes and insurance to lawyer fees and bank charges. These fees vary around the U.S. depending on local laws and customs and also in proportion to average property prices.

To help you find your way, we at Frontdoor calculated the additional fees that homebuyers must pay when purchasing the average-priced property in each U.S. state.

What We Did

We used Houzeo to get a cost estimate for the 20 common additional charges home buyers face in every state, sourcing average local prices from Zillow and down payments from Realtor. These charges include Origination Charges, Services the Borrower Did and Did Not Shop For (such as appraisal fees and survey fees), Taxes, Prepaids, Initial Escrow Payments and Owner Title Insurance. We ranked all states by the size of their fees as a percentage of the average local property price and also the hidden fees they pay a greater or lesser price premium for compared to the national average.

Key Findings

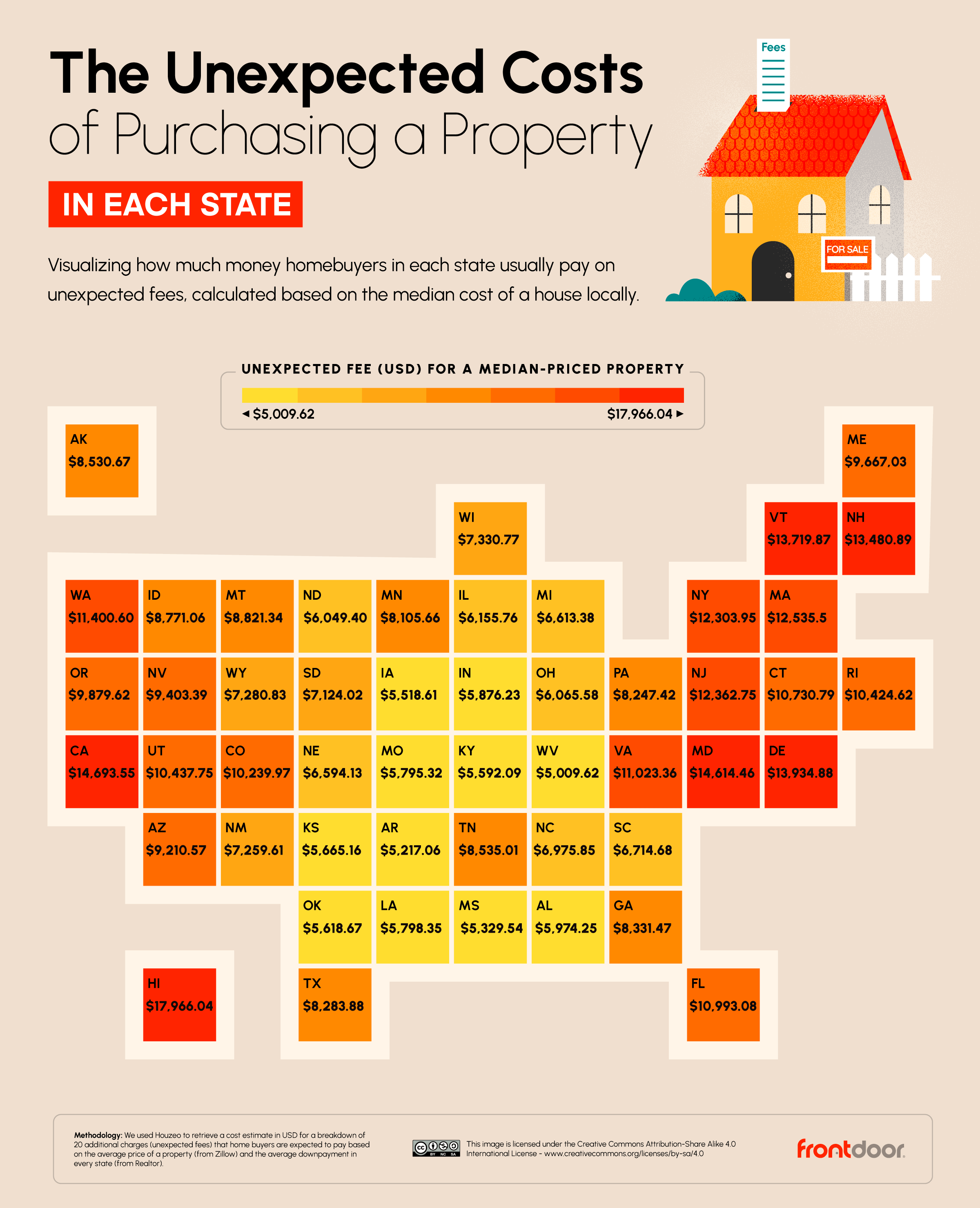

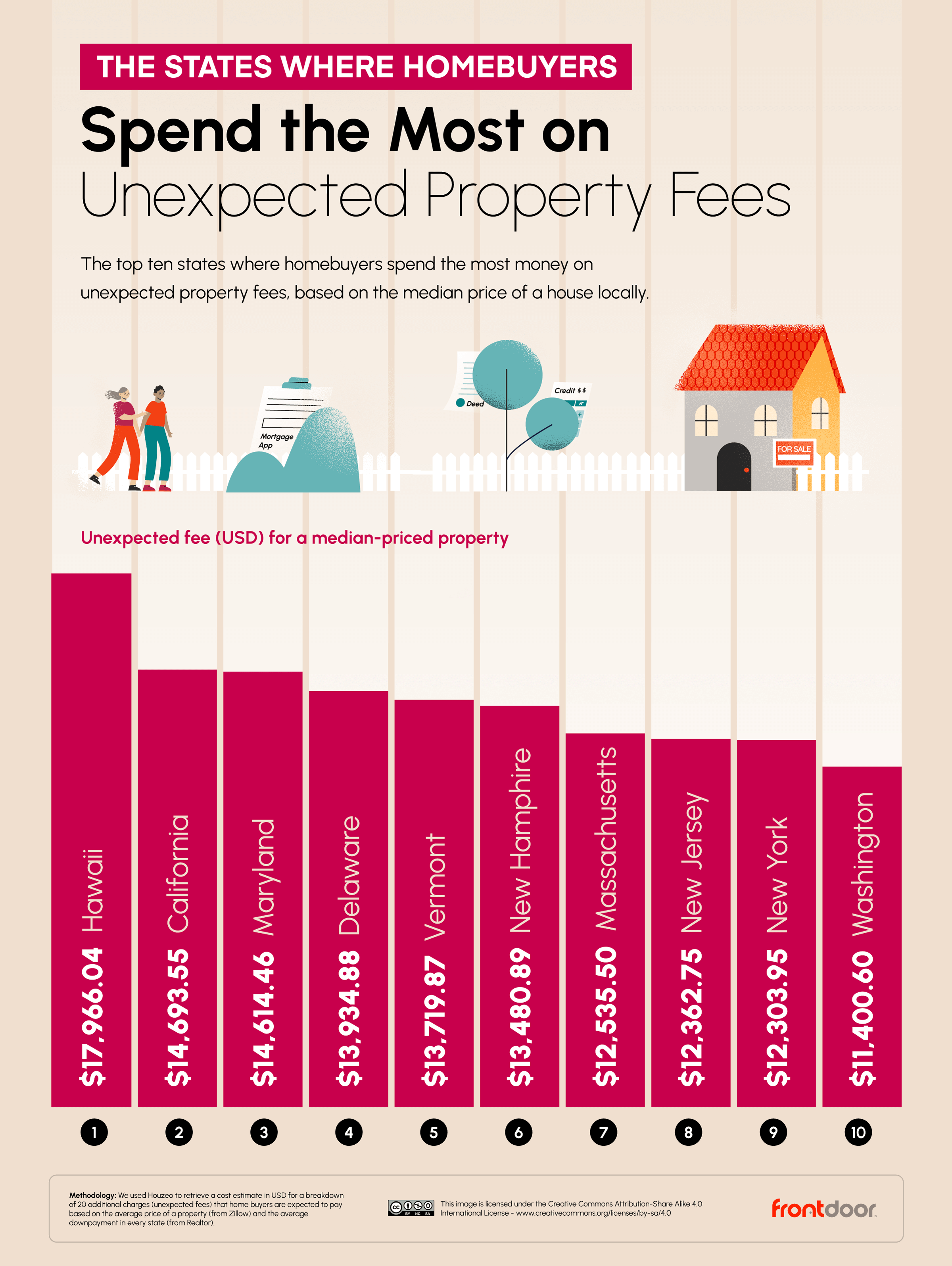

- In Hawaii, homebuyers pay an average of $17,966.04, based on the median price of a house locally, this is the largest amount of unexpected fees.

- However, as a percentage of the total property price, homebuyers in Hawaii pay the 9th cheapest cost, with unexpected fees accounting for only 2.16% of the total price.

- At the opposite end of the scale, in West Virginia, homebuyers pay an average of $5,009.62, based on the median price of a house locally, this is the smallest amount of unexpected fees.

- However, as a percentage of the total property price, homebuyers in West Virginia pay the 4th highest cost, with unexpected fees accounting for 3.25% of the total price.

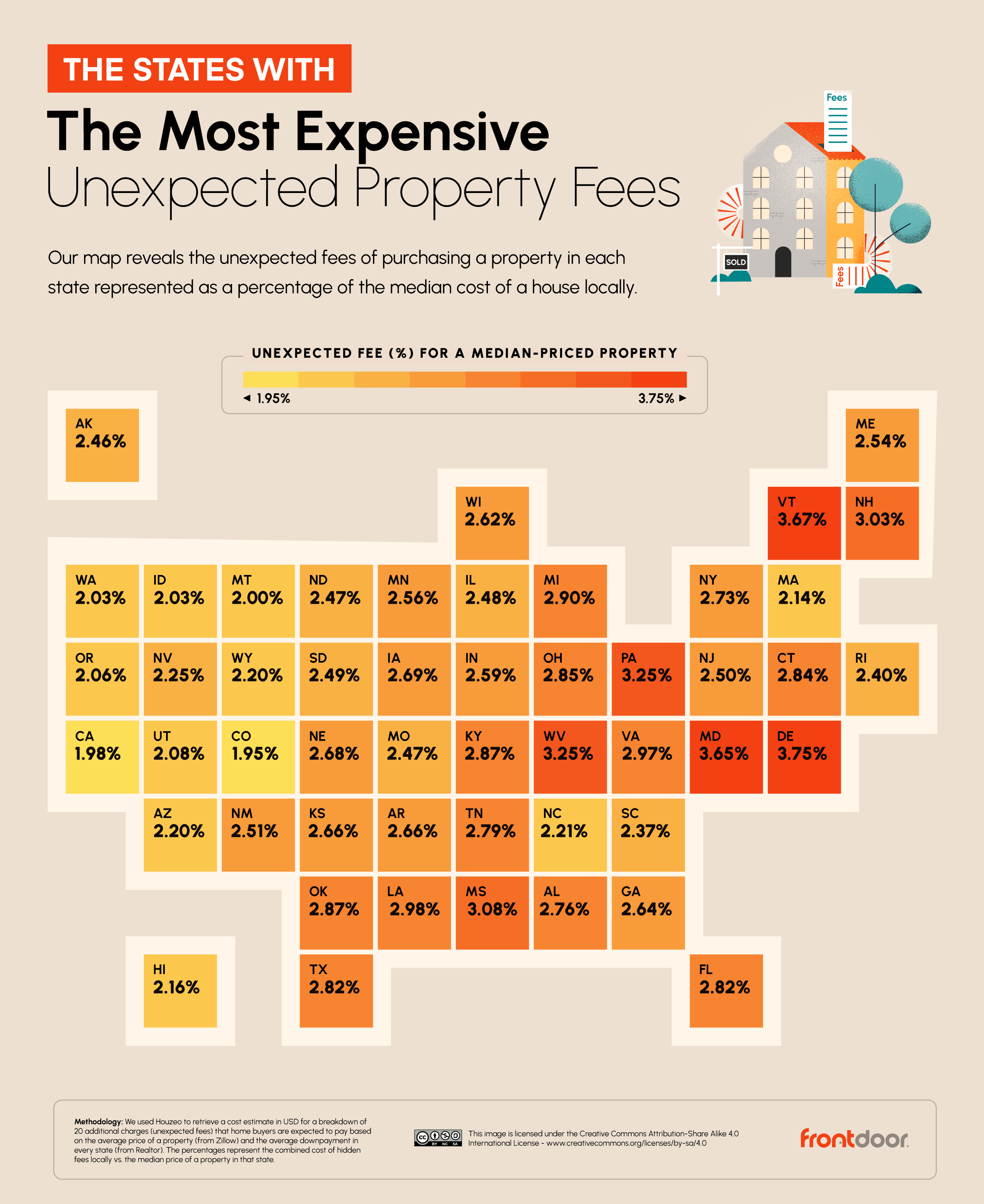

- Colorado is the state with the cheapest home buyer fees, equal to an average of 1.95% of the average local property price.

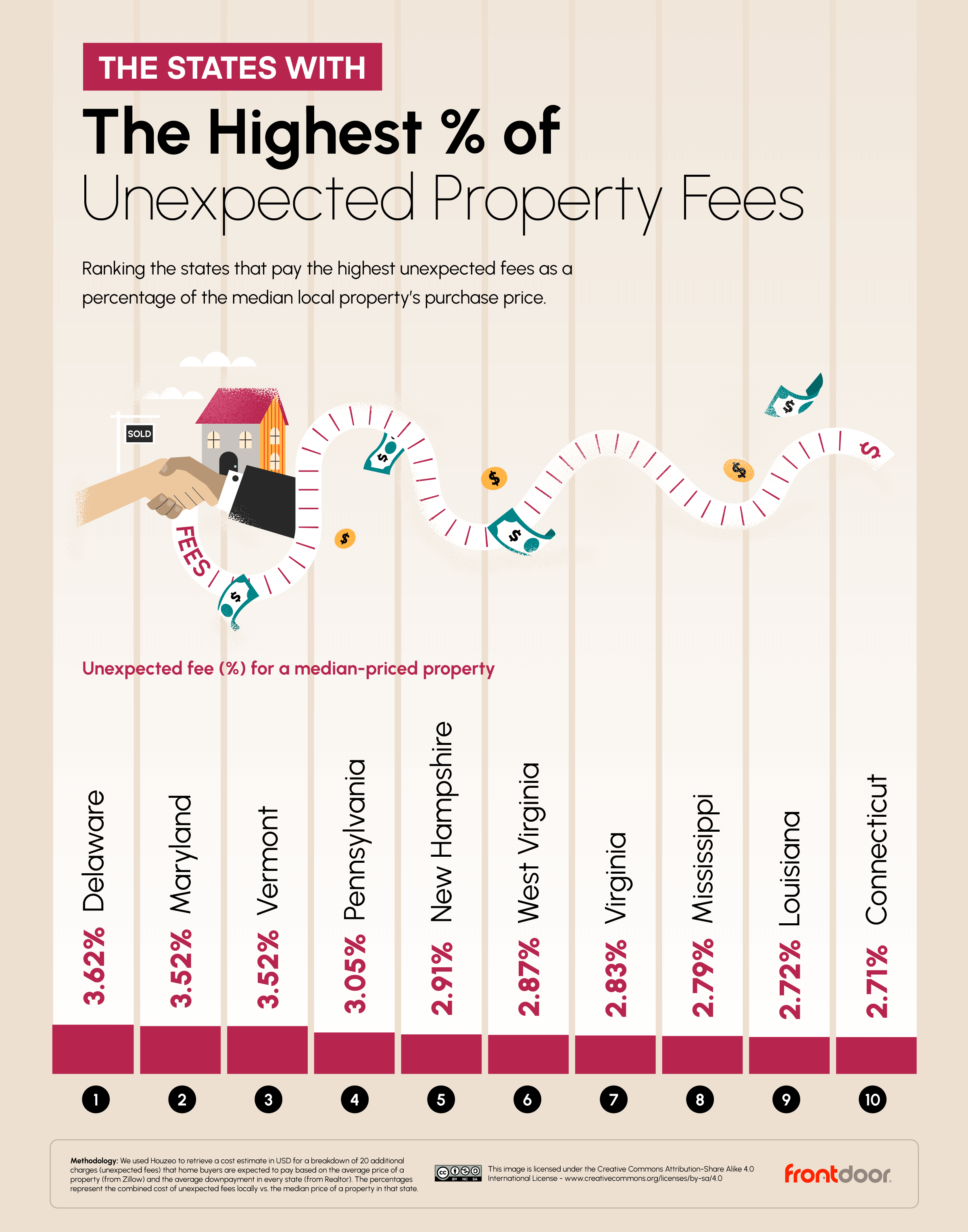

- Delaware is the state with the most expensive home buyer fees, equal to an average of 3.75% of the average local property price.

The States Where Homebuyers Spend the Most and Least on Unexpected Property Fees

First, we looked at the states with the highest average unexpected home buyer fees in dollars. Hawaii tops the list with almost 18,000 dollars ($17,966.04) of unexpected fees on average. This will come as no surprise to anyone living in Hawaii, as the state has the highest living costs of anywhere in the U.S.

There’s a drop of almost 3,000 dollars before we reach the second-highest state for hidden home buyer fees. Californian homes have an average of $14,693.55 in unexpected fees, which accounts for around 2% of the property price.

At the other end of the scale, Arkansas and West Virginia are the states with the lowest average unexpected home buyer fees, with $5,217.06 and $5,009.62 in fees, respectively.

The states with the largest unexpected home buyer fees in dollars aren’t necessarily those with the highest property prices. It is true for both Hawaii ($831,808.10) and California ($743,434.70) that the high average property price is the reason that the home buyer fees are so large. However, the third and fourth-place states for the highest fees in dollars, Maryland ($400,706.60) and Delaware ($371,811), have average property prices around half that of Hawaii and California.

For states like Hawaii and California, the large total cost of unexpected home buyer fees in dollars is not considerably expensive when the total value of the property is taken into account. However, it is in states like Maryland and Delaware where unexpected home buyer fees are truly expensive as the cost of these fees as a percentage of their properties' total price are some of the highest in the U.S.

The States With the Cheapest and Most Expensive Unexpected Property Fees

The states where home buyer fees are cheapest are towards the West. Colorado (1.95%) and California (1.98%) are the cheapest, followed by Montana, Idaho and Washington. The average property is significantly more expensive in these states than it is in the Northeast of the country, and this drives down the relative cost of unexpected fees. However, the average Colorado property ($526,780) is significantly lower than that of California ($743,435), despite “skyrocketing” property prices and taxes that are making it harder to buy or maintain a home in the Centennial State.

The upside for home buyers in Colorado is that there’s less competition for homes. “Buyers really have the opportunity to be picky right now,” says Matt Leprino, Colorado Association of Realtors spokesperson. “They can spend a full weekend looking at homes before they have to make a decision rather than making a decision on an hourly basis because there’s 15 other people lined up.”

When looking at unexpected home buyer fees as a percentage of their property’s total price, the four states with the most expensive unexpected fees are in the Northeast. Delaware (fees equal 3.75% of property price), Vermont (3.67%) and Maryland (3.65%) edge ahead of fourth-placed Pennsylvania (3.25%).

In Delaware, that means paying an average of $13,934.88 in fees on an average-priced property of $371,811. Nearly two-fifths of Delaware’s home buyers are 55 or over, and the average first-time buyer is now 36 — a record high for the state.

The lion’s share of unexpected home buyer fees crops up during or after closing a property purchase. These fees can equal as much as 3.62% of the property price, as they do in Delaware. In Hawaii, which has the most expensive average property prices, closing fees can cost as much as $17,483 on the average-priced property, despite working out at just 2.10% as a percentage.

Buyers in three states can expect to pay under $5,000 in closing fees on the average property. Those states are Mississippi (2.79%), Arkansas (2.39%) and West Virginia (2.87%). However, Colorado and Montana pay the lowest fees proportionally. They are tied with an average of 1.85% in closing fees.

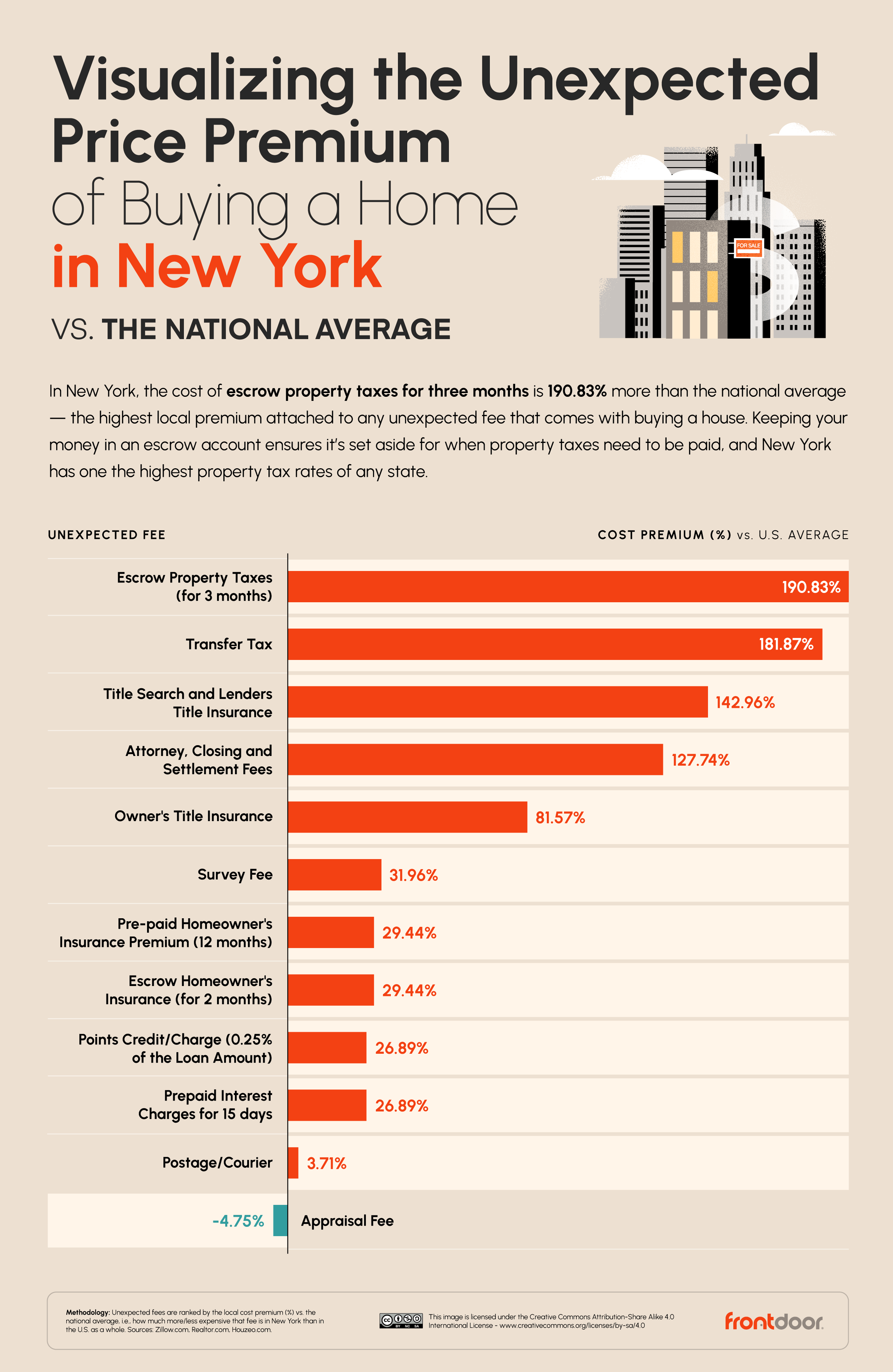

The Unexpected Fees with the Biggest and Smallest Premiums for Homebuyers in New York

Next, we examined which fee categories are disproportionately more expensive in four key states. In New York, Escrow Property Taxes (for three months) cost nearly twice (190.83%) the national average. This category refers to the first three months of property taxes, which the buyer should deposit in an Escrow account to guarantee payment in the early days of ownership.

Property taxes in New York vary from county to county, averaging around 1.4% of the property value. Homeowners in Nassau, NYC, Rockland and Westchester tend to pay the most in absolute terms. However, buyers in New York can take comfort that their appraisal fees average out a notch below the national average (-4.75%).

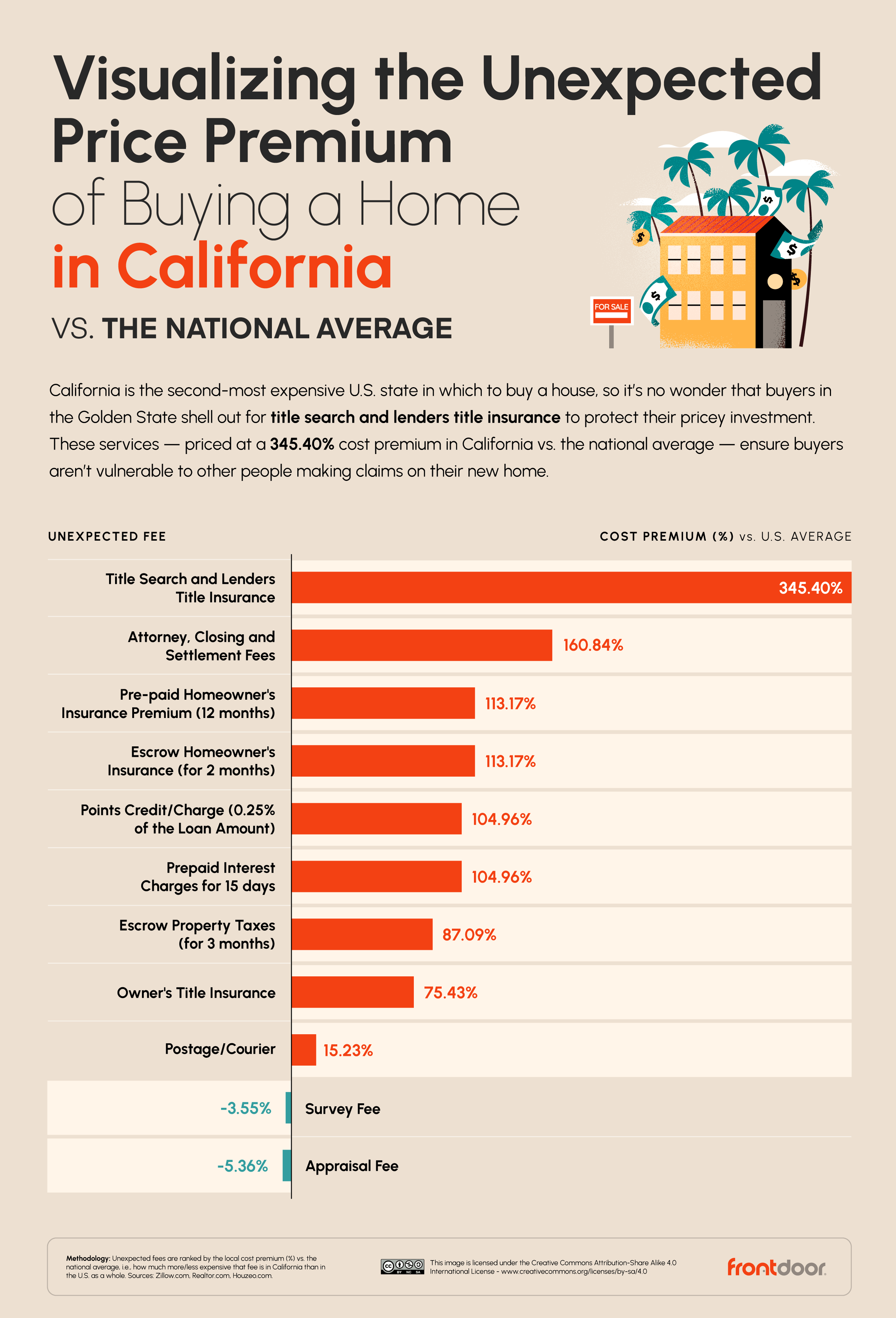

The Unexpected Fees with the Biggest and Smallest Premiums for Homebuyers in California

The biggest fee premium for homebuyers in California is Title Search and Lenders Title Insurance, which averages 345.40% of the national average. Title Search is a check that’s carried out to ensure the deeds, court records and property and name indexes are not compromised. The Lenders Title Insurance protects the lender in the eventuality that something of this nature crops up after purchase. However, the buyer usually pays for this insurance.

California is cheaper than the national average for just two of these 11 categories: Survey Fees (-3.55% against the national average) and Appraisal Fees (-5.36%). However, Californians can still expect to pay thousands more than the U.S. average in fees for the average locally-priced house.

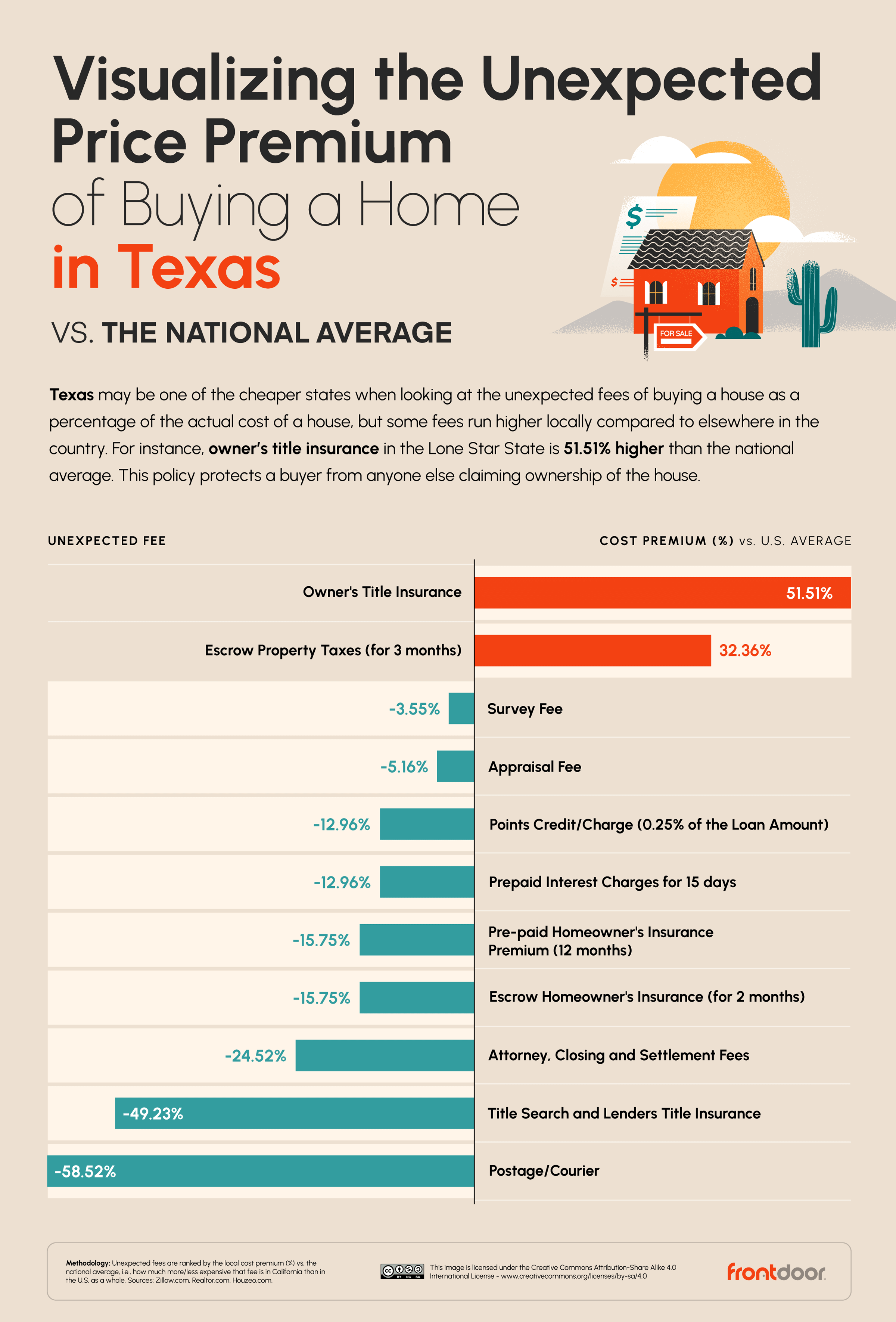

The Unexpected Fees with the Biggest and Smallest Premiums for Homebuyers in Texas

Texan homebuyers get a pretty good deal on fees. Only in two of the 11 categories do homebuyers in Texas pay higher fees against the national average. These are Owner's Title Insurance (51.51% more) and Escrow Property Taxes (for three months) (32.36%). Some homeowners face reduced property taxes in Texas following the approval of Proposition 4 at the end of 2023.

The fee categories where Texans make the biggest savings against the national average are Title Search and Lenders Title Insurance (-49.23%) and Postage/Courier fees (-58.52%). These are relatively low costs anyway, compared to Owner's Title Insurance and Property Taxes. Still, it is also worth noting that Texans save an average -of 15.75% on their Pre-paid Homeowner's Insurance Premium, which saves a three-figure sum against the national average.

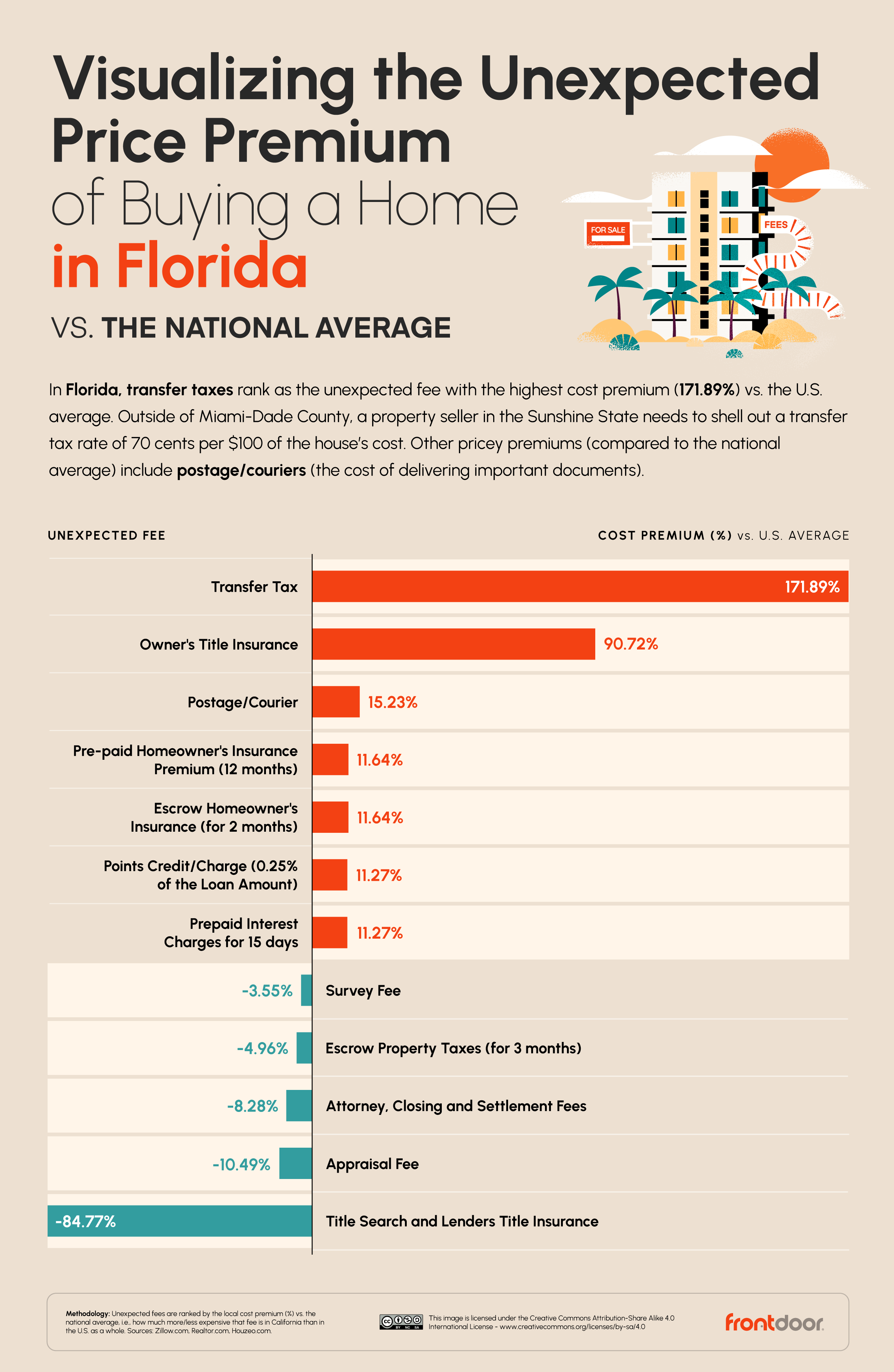

The Unexpected Fees with the Biggest and Smallest Premiums for Homebuyers in Florida

Transfer Tax costs 171.89% more in Florida than the national average; on the average Florida home, that bill comes to $1,815.81. Transfer Tax covers the transfer of deeds from the seller to the buyer and is calculated as a percentage of the property price, although in some places, there is a sliding scale or cut-off point at which the rate changes. Not every area charges this tax (Alaska and Texas are among the states that don’t). Florida has among the highest rates, at 0.7% across most of the state.

There are five categories in which Florida homebuyer fees are less than the national average: Survey Fee, Escrow Property Taxes, Attorney, closing and settlement fees, Appraisal Fee, and Title Search and Lenders Title Insurance. But these are overshadowed not just by Florida’s disproportionate Transfer Tax charges but by a premium of 11-12% on substantial costs such as Homeowner's Insurance Premium, Escrow Homeowner's Insurance, Points Credit/Charge and Prepaid Interest Charges.

In the case of pre-paid insurance, the Florida premium is likely to be a three-figure sum, which requires budgeting for. However, it may relieve you of some monthly insurance payments until those 12 months are up.

3 Money-Saving Tips for First-Time Homebuyers

Buying a home is a rewarding process, but it comes at a financial cost beyond your new property's price. To keep costs down, plan ahead and follow these tips.

- Make a budget

Figure out what you have now, what’s coming in and your likely costs each step of the way. This includes your research costs, down payment, buyer fees, the cost of moving and essential set-up costs for your new home. Seeing your budget laid out like this can help identify potential savings and tripping points.

- Speak to an independent mortgage expert

Your regular or local bank advisor has a vested interest in steering you toward their bank’s products. Ask trusted friends and family for tips on a reliable and experienced financial advisor who can find you the most appropriate mortgage for your needs — to help you get the best home for your money and reduce costs in the long run.

- Put down the best down payment you can

A larger down payment can reduce lender fees and long-term repayments. Look into homebuyer down payment assistance (DPA) and consider any assets you can sell off. However, be cautious of taking extra loans or credit to build your down payment.

Buying a home can be an emotional rollercoaster. But figuring out the most unpleasant bends ahead of time can help keep you on budget and on target for your dream property. Stay aware of local rules and law changes — and don’t be afraid to reach out when you need a helping hand.

Open the Frontdoor

With the Frontdoor app, a better way to home repair is here. You can video chat with plumbing, electrical, appliance, HVAC, and handyman Experts in real-time for all your home repair needs. They’ll give you step-by-step guidance to complete the repair or provide you with a list of local Pros when in-home help is needed. Download the Frontdoor app today to start taking control of your home repair to-do list. Your first video chat is free!

Methodology

For this research, we calculated the additional fees that homebuyers have to pay when purchasing the average-priced property in each U.S. state.

We took the average price of a property per state from Zillow.com and the average downpayment of a property per state from Realtor.com to retrieve a cost estimate per U.S. state from Houzeo.com on 20 additional charges that home buyers typically pay during the pre-close and close of a property purchase.

These charges fall under eight categories: Origination Charges, Services the Borrower Did and Did Not Shop For (such as appraisal fees and survey fees), Taxes, Prepaids, Initial Escrow Payments and Owner Title Insurance.

States were firstly ranked on having the highest additional % and raw cost of these fees vs. the average price of a property and secondly on which hidden fees they pay a greater or lesser price premium for vs. the national average.

This study was conducted in March 2024.

Additional sources

Ayers, J. (2023). Florida Real Estate Transfer Taxes: An In-Depth Guide. listwithclever.com

DePietro, A. (2023). Property Taxes By State: A Breakdown Of The States With The Highest And Lowest Property Taxes In 2023. forbes.com

Statista Research Department. (2023). Freddie Mac House Price Index price appreciation from 1990 to 2023. statista.com

Was this article helpful?